- China's 'Sex and The City'

- China's 'Super Consumers'

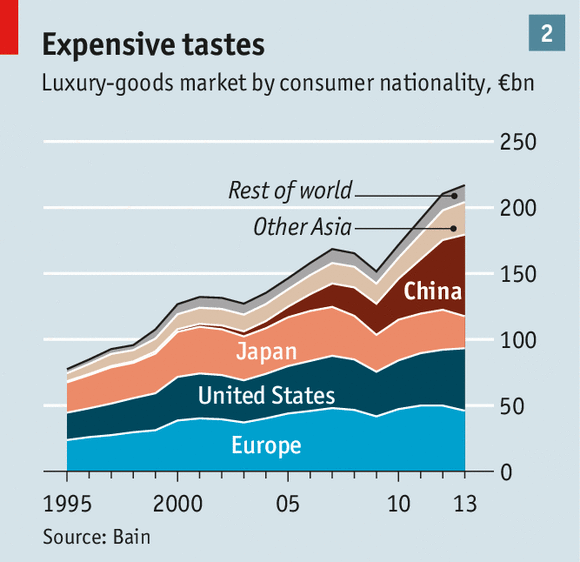

- Chinese are global luxury shoppers

- Still shopping Luxe

- CNY Travelling : 太太's go luxe shopping

- For Rich Chinese, Health is the New Wealth

- Luxury Brands Battle for China’s Younger Consumer

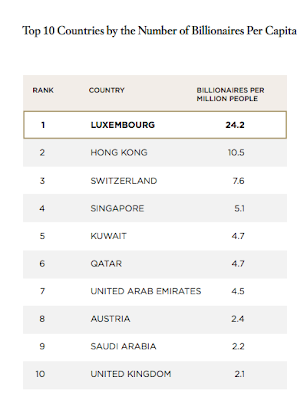

- Asian cities dominate Top 20 Rich List

PUBLISHED JUNE 20, 2014

Asia's millionaires set to overtake North America's

They will outpace the Americans in number and wealth

THIS year, the number of millionaires in Asia is expected to surpass that in North America. By next year, the wealth that these Asian millionaires hold will also overtake that of their North American counterparts, predicted a report by Capgemini Financial Services and RBC Wealth Management.

The two regions are already about neck and neck in the number of such high net worth individuals (HNWIs): Asia-Pacific has 4.32 million of them and North America 4.33 million. Together, they account for almost two thirds of the 13.7 million HNWIs in the world.

In terms of investable wealth, Asians hold US$14.2 trillion, and North Americans US$14.9 trillion. Together, they make up just over half of the world's US$52.6 trillion of HNWI wealth.

But Asia is growing at a faster pace. That is one of the key takeaways from the 2014 World Wealth Report, said account executive for Capgemini Asia Pacific

- Over two-thirds of luxury shopping by Mainlanders is done Overseas

- China Wealth Report 2013 - Group M & Hurun

- Hurun 2014 Wealth Survey

- Flash, Dash, Lots of Ca$h

- Crazy Rich Asians, the book

Different motivations: Businesses must develop a customer strategy that is tailored to the needs of the Asian customer based on a detailed understanding of Asian consumer behaviour and local market conditions.

PUBLISHED NOVEMBER 29, 2013

Rise of the affluent Asian shopper

Brands must cater to him or her via creative strategies

PwC's recent study on the global retail apparel industry makes it clear that there are three main areas where Asian customers differ significantly from shoppers in the US and Europe.

WITH the continued growth of Asia's developing economies, an unprecedented proportion of the region's population is moving up the socio-economic ladder. Newly affluent consumers are not only spending more, they are also spending in different ways than their counterparts in more developed economies.

Findings from a recent study on the global retail apparel industry, titled PwC's Experience Radar 2013, show how local culture and practices in developing Asia drive different types of purchase decisions for regional consumers, and reveal features in the retail shopping experience that would inspire those consumers to pay a premium.

Beyond retail, cultural insights and learnings gleaned from the Experience Radar can also inform other industries seeking to push their brands into new markets.

From the study, there are three main areas where Asian customers differ significantly from shoppers in the US and Europe:

1. Outsized importance of brand, among the most loyal brand shoppers in the world.

Two-thirds of shoppers in developing Asia agree that access to leading branded goods is the heart and soul of their ideal apparel shopping experience.

These newly affluent consumers place so much value on it that they are four times more willing to pay for access to branded apparel than shoppers in developed nations.

Status, style and quality are the leading determinants of purchase decisions. Shoppers in developing Asia are more willing than shoppers in more developed nations to splurge on mainstream and luxury apparel brands. Brands telegraph the shopper's status, which influences how he or she is perceived on the social ladder. And, among the upwardly mobile, branded apparel is seen as a way of tapping into the latest global styles.

In developing Asia, quality trumps price as a reason to buy. Apparel quality is not a given in Asia. In 2012 alone, developing Asia produced US$24 billion worth of knock-off apparel.

In developed countries with generally higher merchandise quality and stiffer competition, shoppers are far more concerned with price. One-third of shoppers in developing Asia cite quality as a reason to buy versus less than 1-in-5 who shop based on price. Among developed country shoppers, more than one-third emphasise price while just one-quarter base their purchase decisions on quality.

What this means for businesses

- Align price with brand equity: For luxury brands, premium pricing reflects exclusivity and quality, which attracts affluent developing Asia shoppers looking to showcase their status.

- Guarantee authenticity: Help assure consumers of the authenticity of your products by providing product information and demonstrations both in-store and online, and by posting online authentication guides to help consumers identify counterfeits.

2. Other people's opinions matter - a lot more.

Family and friends are the foundation of society in developing Asia. Relationships influence all aspects of culture, including shopping. To inform their decision-making, people create their own trust structures that combine their network of friends and family with influencers such as celebrities and blogs. People value the opinion of those they trust to drive their position on the social ladder.

In developing Asia, peer feedback and celebrity associations with brands are exceptionally influential in driving purchasing decisions. Consumers are much more likely to tap into the opinions of those they trust to figure out what brands to wear, which fashion bloggers to follow, and where to shop. Shoppers in developing Asia are twice as likely as shoppers in developed nations to weigh peer feedback before making a purchase (47 per cent versus 24 per cent respectively).

Shopping with (and for) partners and family is a much more common, everyday occurrence. Nearly two-thirds shop with their partner or family, versus 41 per cent in developed countries. And twice as many (60 per cent) shop for immediate family, versus 33 per cent in developed countries.

Social media plays a significant role in influencing purchasing decisions with shoppers in developing Asia who are also very likely to share their own experiences. Nine in ten shoppers report they are influenced to make purchase decisions by information found on social media (versus approximately 6 in 10 shoppers in developed countries).

Some 87 per cent report sharing their retail experiences via social media channels (double the percentage in developed countries).

Shoppers in developing Asia are willing to pay for more access to peer and/or celebrity opinions about apparel brands. They are willing to pay up to a 47 per cent premium to access platforms that provide peer or celebrity opinions about apparel. By comparison, shoppers in developed countries would pay a 17 per cent premium. In India, where Bollywood produces nearly double the number of films than Hollywood, 42 per cent say they are influenced by the styles and brands of celebrity cultures. Overall, developing Asian shoppers are twice as likely as developed country shoppers to say they are influenced by celebrity cultures.

What this means for businesses

- Activate your brand advocates: Using customer analytics and store knowledge, identify your key brand advocates and cultivate relationships with them through incentives such as discounts and invitations to exclusive events.

- Tap into celebrity culture: In countries like India and China, celebrity culture is a huge driver of lifestyle. Leveraging film stars, sports icons and other celebrities can be a powerful tool in building brand awareness.

- Educate employees: Shoppers in developing Asia are more likely to share a bad experience with friends and family. Educate and empower employees on how to turn issues into opportunities to deepen the customer relationship.

- Create engaging social media platforms: Give customers a platform on which to share and amplify good experiences and raise issues that may need to be resolved.

3. Digital channels are a much more integrated part of the shopping experience.

Seeking better access to branded merchandise and better shopping experiences, most developing Asia shoppers are shopping online - surpassing even their developed country counterparts. Nine out of ten shoppers in developing Asia browse or buy online (versus fewer than 8 in 10 for developed countries). Online experiences can provide the richer, more robust and more personalised shopping experiences that customers in developing Asia crave.

Shoppers are using their smartphones to check prices and reviews in-store, spending an average of 15 minutes online per store visit. One in three customers want to access enhanced product information via in-store tablets.

What this means for businesses

- Harness mobile: Today's shoppers are digitally savvy and crave additive features that use technology. Apps that provide regular style and merchandise tips or augment the in-store experience can attract savvy high-spenders and convince shoppers to stay longer.

- Invest in omni-channel: Many shoppers in developing Asia browse online but buy in-store. Providing customers a seamless experience that allows them to access product information, pricing and their own account information across channels is critical to building a strong retail brand.

So, newly affluent consumers are not only spending more, they are also spending in different ways than their counterparts in more developed economies. This requires businesses to develop a customer strategy that is tailored to the needs of the Asian customer based on a detailed understanding of Asian consumer behaviour and local market conditions.

The writer is director, customer & growth practice, PwC Southeast Asia Consulting

- Chinese consumer - global shopper

- A woman's handbag is her greatest asset

- Crazy Rich Asians, the Book

- Big Fat Chinese Wedding

- Rise of the Asian model...

- Asian aim for luxury, Americans look for 'deals'

There were 2.7 million high net worth individuals (HNWI) in China, and the burgeoning group is forecasted to grow to 2.8 million, equivalent to a 140% increase, by 2015

GroupM Knowledge - Hurun Wealth Report 2012

Rich and Super-Rich Broken Down by Region

No. of Millionaires*

|

Rank

|

Increase of Indiv.

|

No. of Super Rich**

|

Rank

|

Increase of Indiv.

|

||

| Beijing | 179,000 | 1 | 9,000 | 10,500 | 1 | 500 | |

| Guangdong | 167,000 | 2 | 10,000 | 9,500 | 2 | 500 | |

| Guangzhou | 55,000 | 1,500 | 4,100 | 100 | |||

| Shenzhen | 52,000 | 2,700 | 3,400 | 100 | |||

| Dongguan | 18,000 | 3,400 | 900 | 60 | |||

| Shanghai | 140,000 | 3 | 8,000 | 8,200 | 3 | 400 | |

| Zhejiang | 133,000 | 4 | 7,000 | 7,800 | 4 | 350 | |

| Hangzhou | 53,000 | 1,500 | 2,900 | 50 | |||

| Wenzhou | 22,500 | 500 | 2,400 | 70 | |||

| Ningbo | 20,000 | 5,300 | 1,200 | 250 | |||

| Jiangsu | 73,000 | 5 | 5,000 | 4,800 | 5 | 200 | |

| Nanjing | 24,200 | 200 | 1,900 | 100 | |||

| Suzhou | 20,000 | 3,100 | 1,100 | 110 | |||

| Fujian | 38,600 | 6 | 2,600 | 2,400 | 6 | 200 | |

| Xiamen | 12,500 | 300 | 700 | 40 | |||

| Fuzhou | 13,000 | 2,000 | 650 | 90 | |||

| Shandong | 35,000 | 7 | 2,000 | 2,000 | 8 | 100 | |

| Qingdao | 12,500 | 500 | 680 | 60 | |||

| Yantai | 2,500 | 800 | 150 | 40 | |||

| Liaoning | 30,800 | 8 | 1,800 | 2,050 | 7 | 130 | |

| Dalian | 12,500 | 600 | 850 | 100 | |||

| Shenyang | 8,800 | 460 | 650 | 90 | |||

| Sichuan | 25,500 | 9 | 1,500 | 1,800 | 9 | 100 | |

| Chengdu | 15,000 | 500 | 850 | 50 | |||

| Henan | 17,300 | 10 | 800 | 1,200 | 13 | 50 | |

| Tianjin | 17,100 | 11 | 1,100 | 1,250 | 12 | 70 | |

| Hebei | 16,400 | 12 | 900 | 1,300 | 11 | 100 | |

| Shanxi | 15,000 | 13 | 1,000 | 1,350 | 10 | 100 | |

| Hunan | 14,600 | 14 | 1,100 | 830 | 17 | 70 | |

| Hubei | 14,400 | 15 | 900 | 1,080 | 14 | 80 | |

| Wuhan | 7,500 | 2,790 | 450 | 100 | |||

| Shaanxi | 14,000 | 16 | 1,000 | 830 | 17 | 70 | |

| Xi’an | 7,000 | 2,810 | 300 | 40 | |||

| Inner Mongolia | 13,500 | 17 | 1,000 | 850 | 16 | 60 | |

| Erdos | 4,000 | 230 | |||||

| Hohhot | 3,200 | 180 | |||||

| Chongqing | 12,500 | 18 | 1,000 | 800 | 20 | 70 | |

| Heilongjiang | 11,800 | 19 | 800 | 780 | 21 | 50 | |

| Harbin | 6,500 | -240 | 450 | 40 | |||

| Jiangxi | 9,600 | 20 | 600 | 830 | 17 | 70 | |

| Anhui | 9,200 | 21 | 700 | 900 | 15 | 50 | |

| Jilin | 8,000 | 22 | 500 | 520 | 23 | 40 | |

| Yunnan | 6,000 | 23 | 500 | 540 | 22 | 40 | |

| Guangxi | 5,400 | 24 | 400 | 400 | 24 | 30 | |

| Hainan | 4,200 | 25 | 200 | 170 | 27 | 10 | |

| Guizhou | 3,200 | 26 | 200 | 280 | 25 | 20 | |

| Xinjiang | 3,200 | 26 | 200 | 260 | 26 | 20 | |

| Ningxia | 870 | 28 | 70 | 95 | 28 | 5 | |

| Gansu | 750 | 29 | 50 | 85 | 29 | 5 | |

| Qinghai | 650 | 30 | 50 | 55 | 30 | 5 | |

| Tibet | 430 | 31 | 30 | 45 | 31 | 5 | |

| Total | 1,020,000 | 60,000 | 63,500 | 3,500 |

http://www.jingdaily.com/good-news-for-luxury-chinas-super-rich-still-on-the-rise/27443/

The number of HNWIs in Hong Kong increased by just over 26% in 2012 and was equal to nearly 233,220. The combined value of their wealth was worth around USD 1.1 billion, with almost 40% of their wealth held abroad. In 2012, the real estate asset class captured a 35.6% share of Hong Kong’s total HNWI assets, which made it the dominant asset class. It was followed by business interests, equities and cash. In the same year, the number of UHNWIs was 3,308, with each holding around USD 104 million on average.

The number of HNWIs in Hong Kong will likely increase by 29% between 2013 and 2017, climbing to approximately 339,700 by the end of the forecast period. The HNWIs’ wealth is poised to grow by 34% through 2017 and amount to USD 1.7 billion by 2017. Source

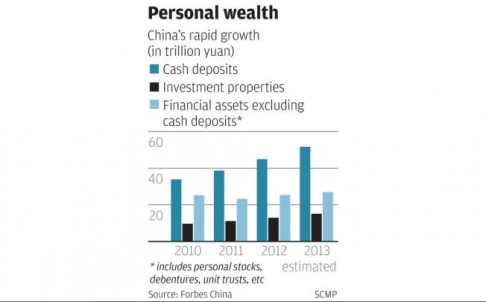

Below the super-rich, Forbes counts 10.3m Chinese as wealthy

Forget the super-rich; how did the merely wealthy mainlanders – with liquid assets of US$100,000 to US$1m – fare last year, magazine asks

Saturday, 30 March, 2013 [UPDATED: 06:11]

Personal wealth

Reports about China's uber-rich have become common, with Forbesmagazine and the Hurun Report regularly compiling lists of the wealthiest and their relative fortunes.

In September, for example, Hurun published its list of the 1,000 richest people in China, who had average wealth of US$860 million. The list was topped by beverage magnate Zong Qinghou, worth an estimated US$12.6 billion.

In September, for example, Hurun published its list of the 1,000 richest people in China, who had average wealth of US$860 million. The list was topped by beverage magnate Zong Qinghou, worth an estimated US$12.6 billion.

Three weeks later, Forbes issued its annual list of the 100 richest mainlanders, again topped by Zong, whose fortune it estimated at US$10 billion.

Now Forbes has turned its focus on the lower rungs of the wealth ladder, calculating that the number of people with liquid assets of between US$100,000 and US$1 million reached 10.26 million last year, and is expected to top 12 million this year.

More than a third of them were born in the 1970s and the top three industries they were involved in are finance, trade and manufacturing, its study said.

Three-quarters of respondents surveyed said they had no plan to emigrate, but the same percentage expressed a wish to send their children to study overseas. The United States was their first option.

Forbes, which surveyed 1,196 people with the required disposable assets and extrapolated the total based on statistical models, said private investable capital on the mainland totalled 83.1 trillion yuan (HK$102.7 trillion) by the end of last year, up 13.7 per cent from 2011.

The assets of the mass affluent came mainly from salaries, bonuses and investment income; the most popular investment channels for them were wealth management products, stocks and property.

Around 55 per cent were male, more than half were university graduates, and they had average disposable assets of 1.33 million yuan.

According to Forbes, around 54 per cent of the respondents had annual household incomes of 110,000 yuan to 500,000 yuan, 27 per cent had incomes of 510,000 yuan to 1 million yuan, and 14 per cent earned 1 million yuan to 5 million yuan.

Two-thirds said their annual household spending was below 300,000 yuan, and their three major expenditure items were daily expenses, their children's school fees and investments.

Most had increased spending on travel, a major leisure activity for them. Other popular pastimes included exercising, driving cars and collecting antiques, luxury goods and modern art.

The survey found 40 per cent owned at least three properties.

For many of the respondents, achieving financial freedom was their ultimate goal. Nearly six out of 10 said they had yet to realise this, and more than half said it would take 6 million yuan to 30 million yuan to get there.

NEW WEALTH of CHINA

Quote by Ken Kwan, author of Crazy Rich Asians

IF SHOPPING WERE AN OLYMPIC EVENT,

- U.S. retailers pushed to relax rules for the Chinese to visit to facilitate visas so that they could come to spend money at retailers.

- The average Chinese tourist spends $6,000 while in the U.S. according to the Commerce Department. -- 2012 BUSINESS WEEK BLOOMBERG

- Wealthy Chinese spent ~$7.2 billion during their spring holidays abroad this year, a study by the World Luxury Association was reported by the Shanghai Daily.

Chinese tourists accounted for 62 percent of Europe's luxury sales, a 12 percent year-on-year rise.

Hong Kong, Macau, Taiwan and North America were the favourite destinations for Chinese travellers.

The country spent $12.6 billion last year on luxury products, excluding private jets, yachts and cars, representing 28 percent of the global figure. -- 2012 February 2 SIFI NEWS- That's our good friend Yolanda with Karl Lagerfield. She graced the cover of Tatler in April. >> MORE

A 太太 TAITAI WOULD WIN!

Harrods, like everyone, is now setting out its stall for the Chinese: it has hired 60 Mandarin-speaking assistants. In the first quarter of 2011, its sales to this community were up year on year by 40%: it seems they’re as happy as the rest of the world to buy global bling wrapped in the signifiers of tourist-board Old England. >> MORE

New & Young Chinese Money

Keen for the New Rich Chinese

GREATER CHINA HEADS GLOBAL - The Other Way

HAS LUXURY PEAKED IN MAINLAND CHINA?

Asians account for ~ 50% of LVMH's sales

'At this point in time we are missing demand from the Asian part of the world, which is obviously a key driver," Mr Guiony said, adding that consumers from the region account for about 50 per cent of Vuitton sales. LVMH raised Vuitton prices by about 12 per cent in Japan and by 3 per cent to 4.5 per cent in other parts of the world in the quarter, the CFO said. -2013 April 18 BUSINESS TIMES

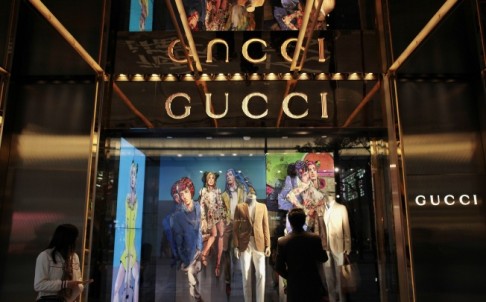

A man watches in front of a window display outside a Gucci store in Hong Kong January 17, 2013. Photo: Reuters

In China’s tier one and two cities it seems that there is a luxury mall on every street. In Shanghai, for example, the growth and expansion seems endless; on the 20 minute drive from my home to the office I pass three new mall developments – each of them plastered with huge billboards advertising the new luxury stores that are soon to open.

Nevertheless, according to market reports, the growth in demand for luxury products is actually slowing. So is the market going to become the number one in the world, overtaking Japan as people expect, or are we about to see a bumpy landing?

Without a doubt the crackdown by the new leaders on gift-giving is playing a part. The ban on government agencies buying luxury goods came into effect in October of last year and resulted in luxury sales slowing in the December quarter.

Traditionally, officials often bought luxury goods, such as watches and bags, as ‘gifts’ for other officials or business contacts to help smooth deals and improve relationships. Of course the real effect of this is impossible to gauge, but one client confessed that the policy was having a big effect on sales in her boutiques across China.

However, it is estimated that less than 25 per cent of luxury spending last year was spent on ‘gifts’, so other factors must also be considered.

The average age of luxury consumers in China is much younger than that in Europe or America. While in London, the luxury consumer tends to be at least 40 years old and wealthy, in China consumers tend to be younger and willing to spend much more of their disposable income on luxury goods.

This does offer grounds to suggest that growth ought to be robust for many years (if a brand can catch someone young, they can keep them for life), but the youthful market in China also holds some potential problems.

First, the Chinese consumer is rapidly maturing – shoppers in Beijing and Shanghai are now truly global consumers and are therefore shifting away from ‘logo’ and high profile signs of luxury spending.

Instead, more and more, they are embracing uniqueness and understatement in luxury items.

Second, these young urban consumers are increasingly experienced in luxury shopping in other markets. Therefore brands are being forced to offer the same consumer experience to Chinese consumers as they do elsewhere.

Luxury brands need to embrace this new consumer or risk losing more and more sales to shopping tourism.

A final factor behind some Western brands reporting a growth slowdown is the increased competition in the Chinese market. As China’s First Lady Peng Liyuan is proving, there are some very hip local luxury brands, often more subtle and individual experiences than their Western rivals.

Additionally, bridge luxury brands -- brands that sit between ‘luxury’ and ‘the high street’ in China are expanding more quickly aided in part by an emerging middle class and a growing online fashion community.

So there are definitely growth opportunities, but brands are going to have to be a little savvier to find them.

For consumers in China though, the loosening of the luxury brand’s traditional grip on the market is exciting, with more choice than ever before.

No comments:

Post a Comment